does binance send tax forms canada

Depending on the countrys tax framework when you trade commodities and the event produces capital gains or losses you may have to pay taxes. Here you can review the project details including the whitepapers the timelines and start staking.

What Are The Best Bitcoin Transfer Services I Need Someone In Canada To Send Me Some Bitcoin How Do I Go About It Quora

But remember - youll only pay tax on half your capital gain.

. Income 2021 Income 2022 15. Answer 1 of 5. Binance does not provide tax or financial advice.

US taxpayers will see the following question just underneath the address line on their Form 1040. It performs over 1400000 transactions per second. The API keys will automatically download your transaction history and keep your data in sync.

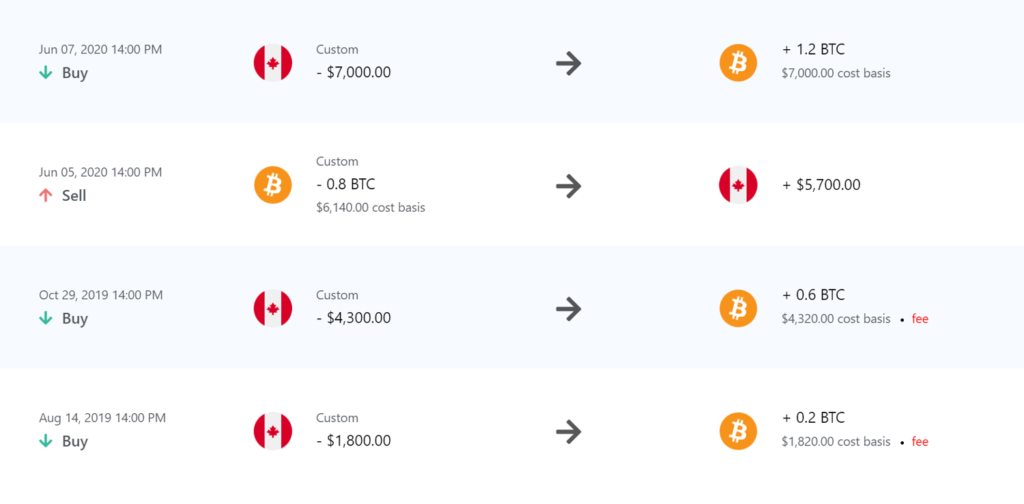

Select currency payment method and withdrawal info. 50 of the gains are taxable and added to your income for that year. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000.

This transaction is considered a disposition and you have to report it on your income tax return. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. You can see the Federal Income Tax rates for the 2021 and 2022 tax years below.

Enter your card information. Binance delivers its users with institutional-grade analysis and reports. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040.

See our full list of pros and cons below. This goes for ALL gains and lossesregardless if they are material or not. BinanceUS does NOT provide investment legal or tax advice in any manner or form.

It is a one stop shop for cryptocurrency trading buying and. Wait for the withdrawal to complete. If you do this through an exchange you better count on the IRS finding out.

BinanceUS makes it easy to review your transaction history. Here is how to withdraw money from Binance to your bank account. Plagued by regulatory legal disputes around the globe.

Report the resulting gain or loss as either business income or loss or a capital gain or loss. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Offers over 500 different cryptocurrencies and a wide selection of investment tools.

Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao. Binance enables exchanging cryptos for Canadians. Calculate and report your crypto tax for free now.

It is secure and 100 safe to trade there. Crypto to crypto in the US is a taxable event. Binance is one of the largest and most comprehensive cryptocurrency exchanges in the world.

The platform came to life in mid-January of 2019 some months after Binance opened a similar subsidiary for the African continent called Binance Uganda. No Binance doesnt provide a specific Binance tax report - but it is partnered with a variety of excellent crypto tax apps like Koinly that. They have their headquarters in Malta.

Go to your fiat and spot wallet. Since then the CRA the IRS and other tax administrators have only fine. The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion.

I am not an accountant. Yes Binance does provide tax info but you need to understand what this entails. Straightforward UI which you get your crypto taxes done in seconds at no cost.

Here is a full review of Binance Jersey. Crypto back to USD yes. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards.

Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. BinanceUS shall not be liable for any consequences thereof. For the 2020 tax year the US individual income-tax return Form 1040 will require taxpayers to disclose their cryptocurrency dealings.

Cryptocurrency is taxed like any other commodity in Canada. Does Binance provide a tax report. You have to convert the value of the cryptocurrency you received into Canadian dollars.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. We explore what it offers pros and cons fees and more in our review. This video demonstrates how you can import your Binance trades into CryptoTraderTax to generate one-click tax reportsFor more information on doing your Bin.

Binance is ranked 19 of 199 in Canada for online crypto exchanges. Binance Jersey is a subsidiary of Binance which allows European residents to perform fiat-to-crypto purchases of cryptocurrency. In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service IRSpromised to pool their resources and expose cryptocurrency users who dodged their tax obligations.

Binance is currently one of the top rated crypto exchanges ranked 19 out of 199 in our reviews of Canada crypto exchanges with a rating of 7810. As it stands right now crypto is an asset especially if youre using it to make profits. You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your marginal tax rate.

Your tax forms will be ready soon. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Go to your fiat and spot wallet.

Complete the security verification. At any time during 2020 did you receive sell send exchange or otherwise acquire any financial interest.

Binance Vs Gate Io 2022 Why Gate Account Is A Must If You Trade On Binance

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

Where To Buy Dogecoin In Canada Beginner S Guide 2022

9 Exchanges To Buy Crypto Bitcoin In Hawaii 2022

Binance Drops Defamation Lawsuit Against Forbes Over Tai Chi Document Nasdaq

Crypto Taxes In Canada Adjusted Cost Base Explained

Binance Vs Gate Io 2022 Why Gate Account Is A Must If You Trade On Binance

Crypto Exchange Coinsquare Ordered To Hand Thousands Of Customers Records To Canadian Tax Agency Nasdaq

9 Exchanges To Buy Crypto Bitcoin In Hawaii 2022

Binance Support Thread R Binance

9 Exchanges To Buy Crypto Bitcoin In Hawaii 2022

How To Handle Your Celsius Network Transactions For Your Taxes By Lucas Wyland Medium

How To Withdraw From Binance 2022 Full Crypto Withdrawal Guide

The Ultimate Crypto Tax Guide What You Need To Know Before April 15 Crypto Law Insider